Employee Injury- What is the Financial Impact?

Our team of professionals here at GovGig understands the substantial strain that workplace injuries can have on both our workforce and our bottom line. As an employer and a government contractor, managing workplace injuries is a very big deal. As outlined within the article below, failure to do so has the potential to greatly impact our workforce, bank account, and ultimately, our ability to bid and win future Federal contracts.

We know how substantial workplace injury can have on our company. Just how substantial is the question?

According to data compiled by the National Bureau of Labor Statistics, more than 65 million workdays were lost as a result of worker injury in 2020 with an additional 34 million lost days from disabling injuries sustained in previous years. 99 million lost workdays in 1 year! No doubt that this caused a serious strain on the physical and financial well-being of each affected worker in addition to the financial impact that each of these injuries had on the companies which employed them.

Often it is very difficult to ascertain the true impact that a single workplace injury can have on an impacted project or company. It has often been said that the cost that you cannot see (indirect costs) can be between 1 - 10 times the cost of direct costs. Numerous factors may affect this cost including injury severity, duration of recovery, and the type of impact that a missing worker may have on the work crew and project among many, many others.

Direct Costs are apparent and can be substantial when added up. They may include:

· Medical expenses

· Cost of repair to damaged property or equipment

· Cost of increased insurance rates

· Loss of income (for the injured worker)

Indirect Costs can be difficult to measure and may include:

· Project downtime

· Cost of bringing in and training replacement workers

· Poor workforce efficiency

· Poor morale

· Administrative costs including accident investigation costs

· Damage to customer relations and negative publicity

· Increase in incident and insurance rates leading to a loss of future business

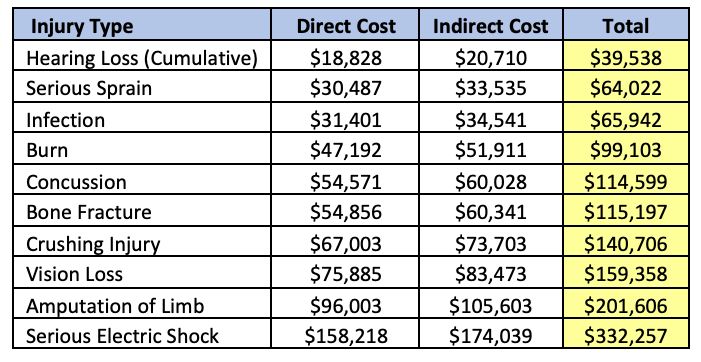

The actual cost of just one injured worker adds up quickly. To help understand the true cost of a workplace injury, OSHA provides a cost estimate worksheet as part of its Safety Pays Program. This process is simple, but the results are surprising. Examples of the average estimated cost by injury have been calculated to be as follows:

On average, employers will spend $120,000 for each workplace injury resulting in medical treatment. For companies operating at an 8% - 10% profit margin, between $1.2M - $1.5M in sales would be needed to offset the cost of this single injury.

It is important to note that injuries not only affect the individual who gets injured but the entire company. An injury hurts production, lowers morale, requires excess administrative efforts, and ultimately removes money from the bottom line.

The truth of the matter is, in addition to the substantial strain that even 1 injury can have on our profitability, elevated incident rates (TRIR) along with high Workers Compensation Premium (EMR) can and will substantially affect your ability to land future work in the Federal sector.

As such, we should be asking ourselves what we as individuals need to be doing to ensure that 1) A workplace is provided free from recognized safety and health hazards so that the likelihood of workplace injury is substantially minimized, and 2) Where we as individuals and as a company currently stand on the safety front and where we need to be better.

Accidents affect each of us whether directly or indirectly. Ultimately our livelihood is on the line if we make a personal decision to work unsafe. Let’s take the time to work safely today for ourselves, for our co-workers, and for the long-term well-being of the company in which we work.

Please let us know if we can help you in your process to build a safer company. Reach out to GovGig should you have any questions.

Note: Sales needed to offset injury can be calculated via the following formula:

Cost of Injury / Net Profit Margin = Sales Needed to Offset Cost

Cory J. Grimmer